IRS Appeals and Writing an Effective Protest.

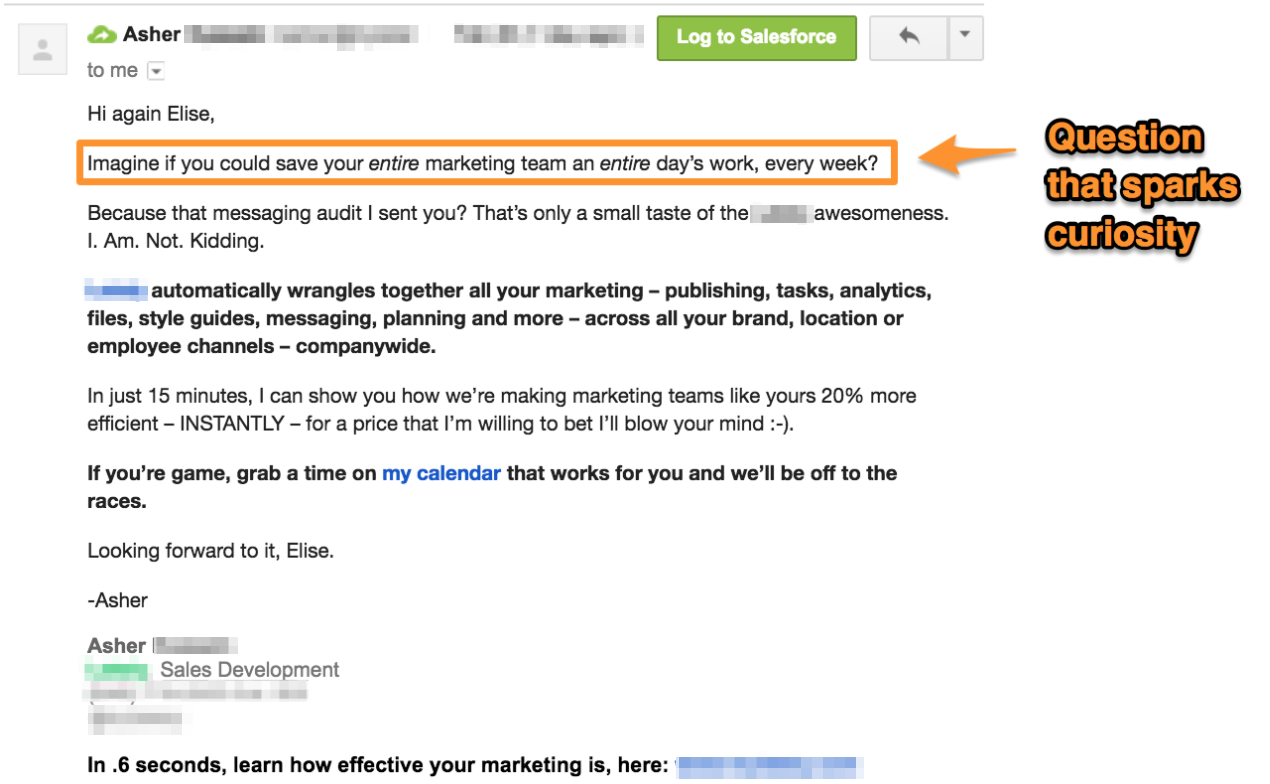

Collection of tax protest letter template that will completely match your requirements. When creating a formal or company letter, discussion style and also style is crucial to making a good impression. These templates supply exceptional examples of the best ways to structure such a letter, and include example web content to act as a guide to layout.

A letter of protest is written to express disproval or objection to something. Formally this type of letter is commonly sent to Government officials, and businesses and individuals involved in trademark disputes through the USPTO.

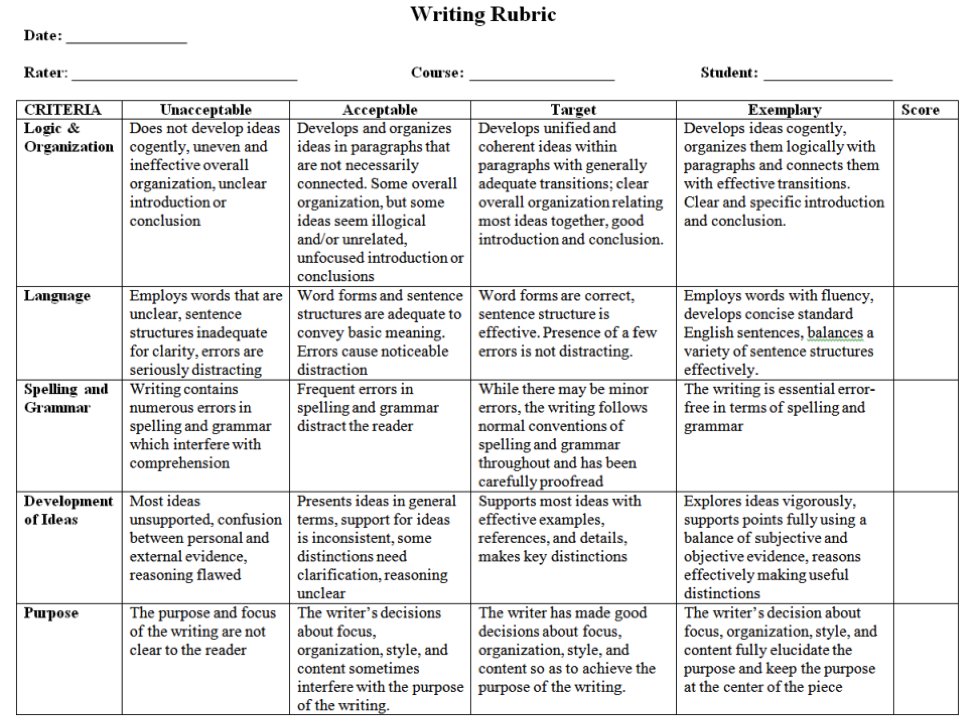

To end on a positive note, thank the recipient for reading your letter. Sign your full name and include contact information -- either an email or mailing address as well as your phone number. Proofread carefully for spelling and grammatical errors, then double check your facts before sending the letter.

As noted above, this property tax appeal letter is just an example, and feel free to edit it as needed for your circumstance. You may need to delete certain portions of the letter, modify the amounts, add additional examples (say of improvements or comparable sales) and make other modifications.

This property tax appeal letter format should include a list of any discrepancies the homeowner believes to be a part of the official assessment. It should list the amount the assessor listed, the amount the homeowner believes the property to be worth and the difference in the 2 figures.

When filing a property tax appeal, there are 3 things that you MUST do every year. And these 3 things every Texas property owner must do when filing your property tax appeal. Always file a protest each and every year, because you don't know if you should appeal until you've seen the appraisal district's evidence.

Appeal Your Property Tax Assessment Dear Property Owner: A few reminders may be helpful regarding your property tax assessment notice. The term “taxable value” was introduced in 1995. It is the value used to calculate your property taxes. Annual growth in taxable value is capped at the rate of inflation, or 5 percent, whichever is less.

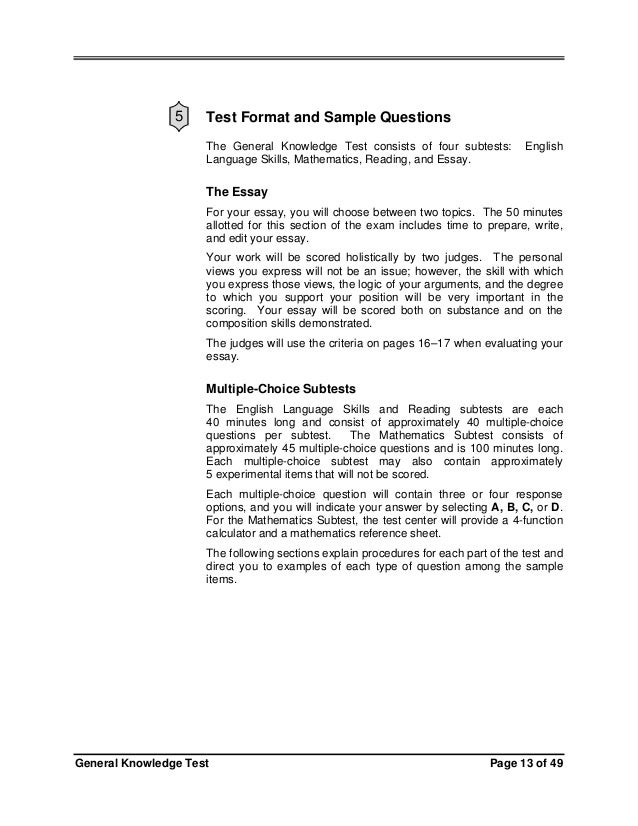

Write and Submit a Protest on Time: If you received an Examination Report from the IRS, write a protest letter, sign it, and mail it to the IRS before the deadline listed in the Report. Provide a complete explanation and attach relevant documents to your protest.

Property tax appeal procedures vary from jurisdiction to jurisdiction. As soon as you receive your proposed property tax notification, check your municipal or county tax assessor’s website to learn what you need to do next. The website should be clearly marked on your notification letter. When you visit the site, note: Protest and appeal.

How to Write a Letter of Explanation to the IRS (With Samples) If you are requesting a penalty abatement for a reasonable cause, you can use the sample letter below to help write your request. You should always address this correspondence to the Internal Revenue Service and send it to the address listed on the written notice of the tax due.

This letter is a reminder to file your 2017 tax year information returns with us if you have a filing requirement. We received information returns from you for 1 or more previous tax years but we did not receive information returns for tax year 2016. What you need to do. File your information returns electronically. If you file 250 or more.

The California bill, for example, provides an administrative hearing to protest an have a specific form to appeal, follow the sample protest letter in Chapter 4. tax assistance letter from the Department by writing the. Department of.. ment of income taxes more than three years after the date you filed the return or the.

Sample Protest Letter to Manager. January 7, 2013. To Lawrence Wells, Manager at Windows Unlimited, On January 5, I purchased blinds for my home and asked to have them installed the next day. I was willing to pay the additional cost and was told the installer would be by to install them in the morning.