How to write an invoice: a step-by-step guide.

How to write an invoice. How to write a receipt of payment. How to make a billing invoice. How to Write a Legal Receipt. Tax: calculations, VAT, self-employment tips and more. How to write a simple invoice. Giselle Diamond - Updated February 21, 2017. The hope of reward adds joy to labour. To let the person for whom you have laboured know that money is due for work done, you need to send an.

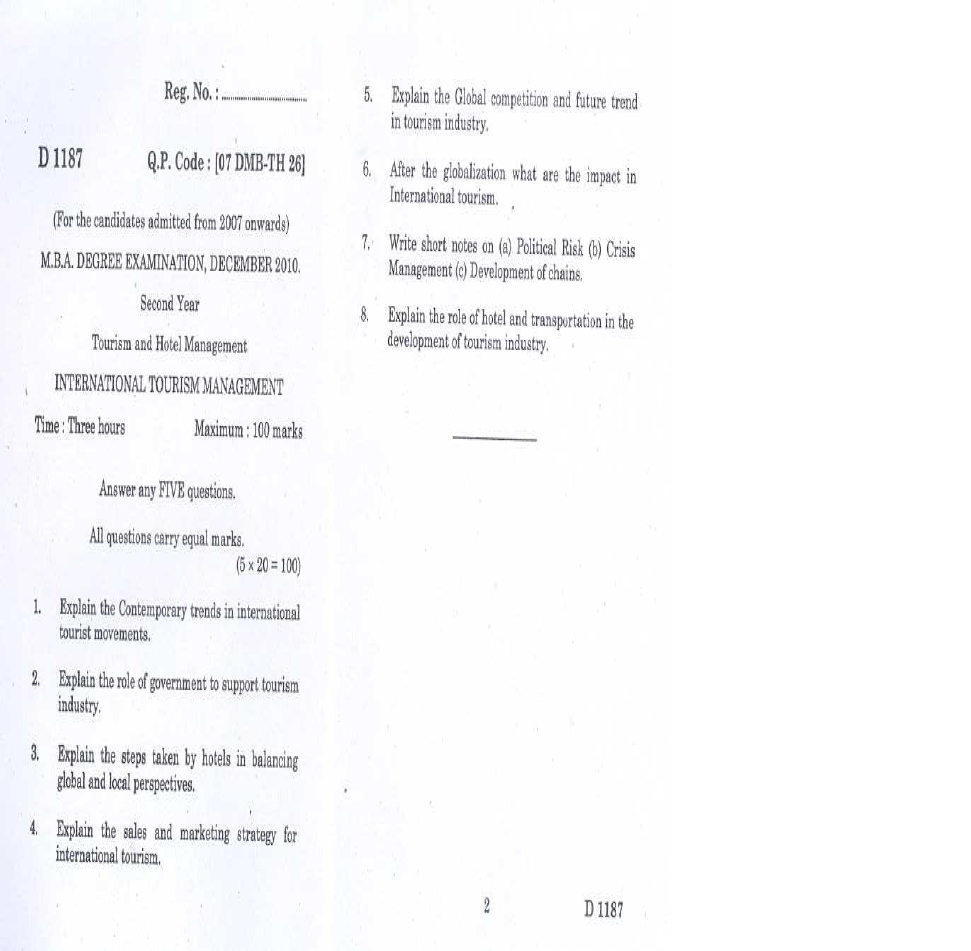

Invoicing and taking payment from customers, what invoices must include, VAT invoices, sole trader invoices, limited company invoices, payment options, charging for late payment, chargebacks.

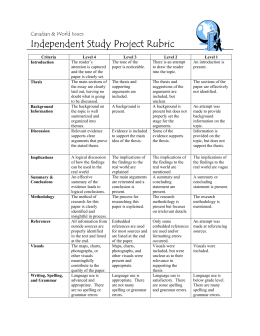

The easiest way to create a numbering system for your invoices might be to start each invoice number with the date, and then include a numeral corresponding to how many invoices you are writing that day. For example, if you will only be writing one invoice on April 25, 2015, your invoice number would be 42520151. If you write a second invoice.

Learn how to write standard invoice payment terms and conditions while sending bills to your clients. Find out about the important elements that must be covered like warranty, advance payments, return policy, late payment fees and much more. Also read about invoice payment terms examples.

The tax invoice can also be used as an evidence to support an Input Tax Credit claim. However, the registered companies can not use the name of Proforma invoice, Temporary Invoice or Sale Invoice in one of their invoices. What Information Should a Tax Invoice Show? Below is the common information that appears on every tax invoice. Take note.

In this case it's usually better to date your write-off transactions some time in the latest period for which you have not yet reported sales tax. The invoice was issued in your last Financial Year, and you have already completed your year-end statements and filed tax returns. You should date the write-off transactions in the current Financial.

This invoice specifically shows the increase in the amount of debt the buyer owes the seller. Prepayment invoice. This is used to record the down payment made by a buyer. Withholding tax invoice. This serves as a record every time you remit withholding tax invoice to the tax authority.

If you are using a limited company as your payment structure you will need to send invoices to your clients for the services you have provided, normally on a monthly basis, and sometimes weekly. This guide explains exactly how to prepare an invoice with an example, together with links to our free and fully editable invoice templates in both Microsoft Word and Microsoft Excel format.

Tax Invoice is the essential document to be issued by a registrant when a taxable supply of goods or services is made. Under VAT in UAE, a Tax Invoice is to be issued by all registrants for taxable supplies to other registrants, where the consideration for the supplies exceeds AED 10,000.

As tough as it is to pay a fee to receive the funds you worked so hard for, at least these costs are tax-deductible. Any bank fees, PayPal charges or other invoicing expenses you pay on behalf of business transactions are considered qualified expenses. And since they are a part of running a business, you can write them off at the end of the.

An invoice has certain requirements that you must abide by, to ensure you are understood by your customers. The invoice format must include the necessary information to make it a legal document, and the relevant legislative references for the correct VAT (value-added-tax) treatment. The first thing you need to do, is check if you are a typical.

How to write an invoice in Italy. First of all, here is a template you can copy and download: Elements of an Italian invoice. The template is a standard invoice to sell products between Italian companies. In the next posts I will show you how to change the invoice if you are selling to foreign companies, or if you are providing services not.

Are you getting paid on time? Using the right messaging makes a huge difference. With an invoice in hand you can follow these tips for writing effective invoice emails to help you get paid on time or deal with past due invoices. We even included sample invoice, reminder, and past due email templates at the end of this post that you are free to use.